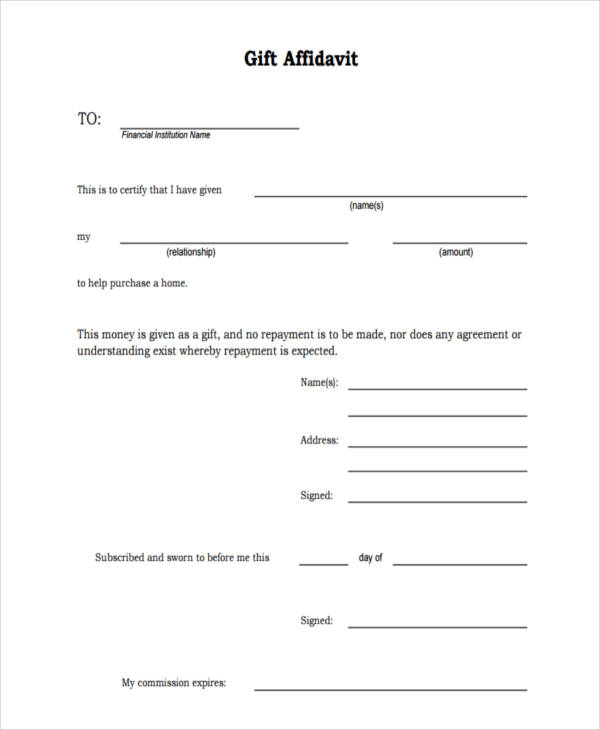

You make a gift if you give property (including money), or. The gift tax applies to the transfer by gift of any type of property. The tax applies whether or not the donor intends the transfer to be a gift. Unlike executing a sales deed, there is no financial transaction involved in the process of gifting a property.The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. It also specifies that the transfer was made voluntarily without any exchange of money between the two parties.

...

However, a property gifted by parents, grandparents, siblings, spouse or children is exempt from taxation. The amount to be paid is determined according to the overall value of the gift.

0 kommentar(er)

0 kommentar(er)